In my last post,

I discussed how inflation's return has changed the calculus for

investors, looking at how inflation affects returns on different asset

classes, and tracing out the consequences for equity values, in the

aggregate. In general, higher and more volatile inflation has negative

effects on all financial assets, from stocks to corporate bonds to

treasury bonds, and neutral to positive effects on gold, collectibles

and real assets. That said, the impact of inflation on individual

company values can vary widely, with a few companies benefiting, some

affected only lightly, and other companies being affected more

adversely, by higher than expected inflation. In an environment where

finding inflation hedges has become the first priority for most

investors, the search is on for companies that are less exposed to high

and rising inflation. The conventional wisdom, based largely on investor

experiences from the 1970s, is that commodity companies and firms with

pricing power are the best ones to hold, if you fear inflation, but is

that true, and even if it is true, why is it so? To answer these

questions, I will return to basics and try to trace the effects of

inflation on the drivers of value, with the intent of finding the

characteristics of stocks with better inflation-hedging properties.

Inflation and Value

When

in doubt about how any action or information plays out in value, I find

it useful to go back to value basics, and trace out the effects of that

action/information on value drivers. Following that rule book, I looked

at the effects of inflation on the levers that determines value, in the

graph below:

Put

simply, the effects of inflation on firm value boil down to the impact

inflation has on expected cash flows/growth and risk. At the risk of

restating what is already in the graph above, the factors that will

play out in determining the end impact on inflation on value are in the

table below:

If you were seeking out a company that would operate as an inflation hedge, you would want it to have pricing power on the products and services that it sells, with low input costs, and operating in a business where investments are short term and reversible. On the risk front, you would like the company to have a large and stable earnings stream and a light debt load.

Looking Back

There

are lessons that can be learned by looking at the past, about how

inflation affects different groupings of companies, though there is the

danger of over extrapolation. In this section, I look first at how

classes of stocks have done over the decades, and relating that

performance to inflation (expected and unexpected). I then examine how

equities have performed in the less than five months of 2022, where

inflation has returned to the front pages.

Historical Data: 1930-2019

To

see how this framework works in practice, let's start by looking at the

performance of US stocks, across the decades, and look at the returns

on stocks, broadly categorized based on market capitalization and price

to book ratios. The former is short hand for the small cap premium and the latter is the proxy for the value factor in returns.

The

distinction that I made between expected and unexpected inflation comes

into play in this table. It is unexpected inflation that seems to have a

large impact on the behavior of small cap stocks, outperforming in

decades where inflation was higher than expected (1940-49, 196069,

1970-79) and underperforming in decades with lower than expected

inflation (1990-99, 2010-19). The value effect, measured as the

difference between low price to book and high price to book stocks was

highest in the 1970s, when both actual and unexpected inflation were

high, but remained resilient in the 1980s, when inflation stayed high,

but came in under expectations.

The 2022 Experience

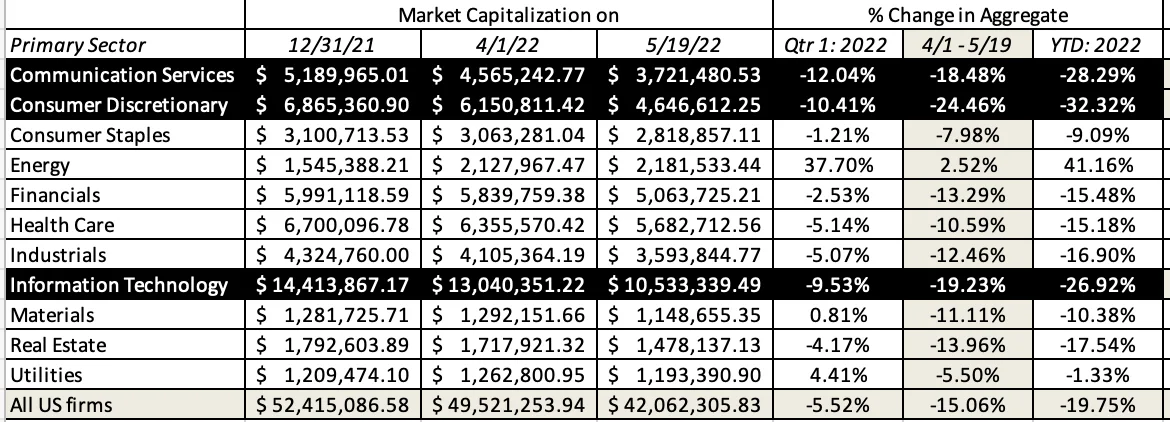

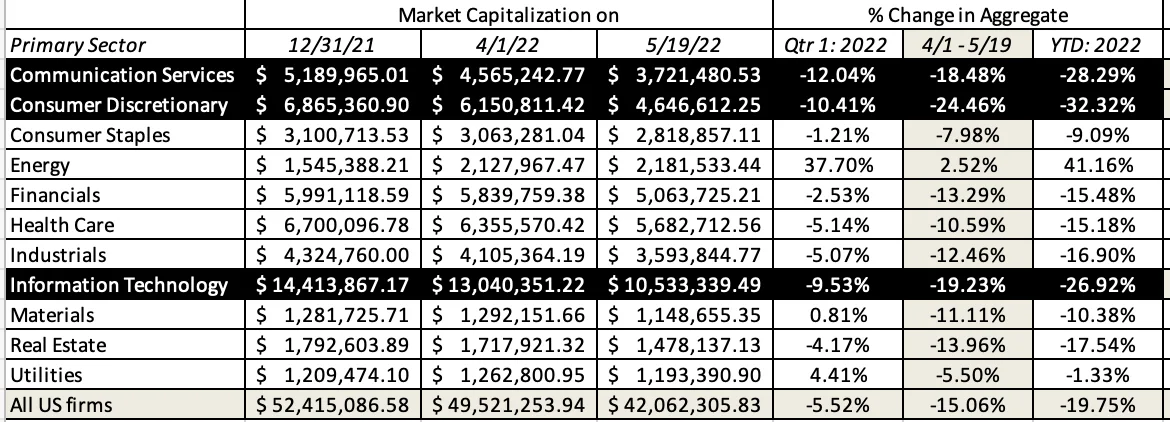

As the focus has shifted back to inflation in the last five months,

it is worth looking at performance across US stocks, broken down by

different categorizations, to see whether the patterns of the past are

showing up in today's markets.. For starters, let's look at the how the

damage done by inflation on stocks varies across sectors, looking at the

2022 broken down in three slices, the returns in the first quarter of

2022 (when Russia competed with inflation for market attention), the

period from April 1 - May 19, 2022 (when inflation was the dominant

story) and the entire year to date.

In 2022, the collective market capitalization of all US firms has dropped by 19.75%,

with the bulk of the drop occurring after April 1, 2022. During the

period (April 1- May 19, 2022), the three worst performing sectors

(highlighted) were technology, consumer discretionary and communication services, and the best performing sectors were energy (no surprise, given the rise in oil prices) and utilities, old standbys for investors during tumultuous periods.

To

check to see if the outperformance of small cap and low price to book

ratios that we saw in the 1970s is being replicated in 2022, I broke

companies down by decile (based on market cap and price to book at the

start of 2022), and looked at changes in aggregate value in 2022:

As

in the 1970s, the small cap premium seems to have returned with a

vengeance, as small cap stocks have outperformed large caps in 2022, and

the lowest price to book stocks have done less badly than high price to

book stocks. To examine the interaction and stock price performance in

2022, I looked at the aggregate returns on firms classified into deciles

based upon both equity risk (betas) and default risk (with bond

ratings):

The

link between equity risk and stock returns support the hypothesis that

firms that are riskier are more affected by inflation, with one

exception: the stocks with the lowest betas have also done badly in

2022. On bond ratings, there is no discernible link between ratings and

returns, until you get to the lowest rated bonds (CCC & below). In a

final assessment, I break down companies based upon operating cash

flows (EBITDA as a percent of enterprise value) and dividend yield

(dividends as a percent of market capitalization).

Companies

that generate more cash flows from their operations and return more of

that cash flow in dividends to stockholders have clearly held their

value better than companies with low or negative cash flows that pay no

dividends, in 2022. Looking at these results, value investors will

undoubtedly find vindication for their beliefs that this is a correction

long over due, i.e., a return to normalcy where safe stocks in boring

sectors that pay high dividends deliver excess returns. I do think that

given how consistently growth stocks have been beating value stocks for

the last decade, a correction was in order, but I believe it is way too

early to proclaim the return of old fashioned value investing.

Bottom Line

This

has been a painful year for investors in US equities, but the pain has

not been evenly spread across investors. Portfolios that are over

weighted in risky, money losing companies have been hurt more than

portfolios that are more weighted towards companies with less debt and

more positive cash flows. Even within some of the worst performing

sectors, such as technology, breaking companies down, based upon

earnings and cash flows, there is a clear advantage to holding money

making, older tech companies than money losing, young tech companies:

The

question of whether these trends will continue to apply for the rest of

the year cannot be answered without taking a stand on inflation, and

the effects that fighting it will create for the economy.

- If

you believe that there is more surprises to come on the inflation

front, and that a recession is not only imminent, but likely to be

steep, the returns in the first five months of 2022 will be a precursor

to more of the same, for the rest of the year.

- If

you believe that markets have mostly or fully adjusted to higher

inflation, betting on a continuation of the small cap and value

outperformance to continue is dangerous.

- To

the extent that there may be other countries where inflation is not the

clear and present danger that it is in the United States, investing in

equities in those countries will offer better risk and return tradeoffs.

As

I noted in my last post, once the inflation genie is out of the bottle,

it tends to drive every other topic out of market conversations, and

become the driving force for everything from asset allocation to stock

selection.

0 تعليقات