It has been my practice for the last two

decades to take a detailed look at how risk varies across countries,

once at the start of the year and once mid-year. In most years, the

differences between the two updates are small, and often ignorable, but

this year's update brings significant changes for many reasons. The

first is the retreat of risk capital, which I talked about in my last

post, not only affects the flow of capital and repricing of the riskiest

assets (high yield bonds, money losing companies) within each asset

class, but also has consequences for the flow of capital across

geographies, with riskier countries feeling the effect more than safer

countries. The second is that this has been a consequential year for

country risk shifts, with Russia's invasion of Ukraine upending risk not

only for those countries, but also in the region, and tumult in Sri

Lanka and Pakistan playing out as risk to investors in both countries.

Country Risk: Drivers and Measures

An

investment in Nigeria or Turkey clearly exposes a firm or investor to

more risks than an otherwise similar investment in Germany or Canada,

but why? Some of the differences can be traced to the stability and

growth prospects of the underlying economies, some to political and

legal structures and some to geography. Rather than provide a laundry

list, I attempted to summarize the four key drivers of country risk

differences in the table below:

Let’s start with political structure,

i.e., the extent of political freedom and democracy in a country, a

sensitive topic and one that is open to subjective measurements, and

draw on a democracy index score computed by the Economist Intelligence

Unit (EIU) every year, with the most recent one mapped below:

|

| Source: Economist Intelligence Unit (EIU) |

As

the Economist noted, a third of the world's population lived under

authoritarian regimes and only 6.4% lived under full democracy, in 2021,

with large differences across regions. From a business risk standpoint,

though, the question of whether you would rather operate in a democracy or a dictatorship is a complicated one,

with the former creating more continuous risk, as laws and regulations

change, as elections often bring in new governments, and the latter more

discontinuous risk, since regime changes, though less frequent, are

often more wrenching and painful.

Second, a country’s risk profile can also be affected by its exposure to violence,

from war, terrorism or internal strife, and the risks that ensue to

businesses that operate in its midst, I looked at differences across

countries, in July 2022, drawing on work done by the Institute for Peace

and Economics:

|

| Source: Institute for Peace and Economics |

Note that the peace scores were updated to reflect the Russian invasion of Ukraine and that the world's hotspots became more violent in 2021 and 2022.

Third, corruption operates as an implicit tax, since business operating in corrupt parts of the world have to build in the associated costs and constraints. Transparency International measures a corruption score for countries, and the results of its 2021 iteration are mapped below:

|

| Source: Transparency International |

Northern

Europe is the standout, when it comes to being free of corruption, but

corruption clearly is a drag on businesses in Latin America, Africa and

much of Asia.

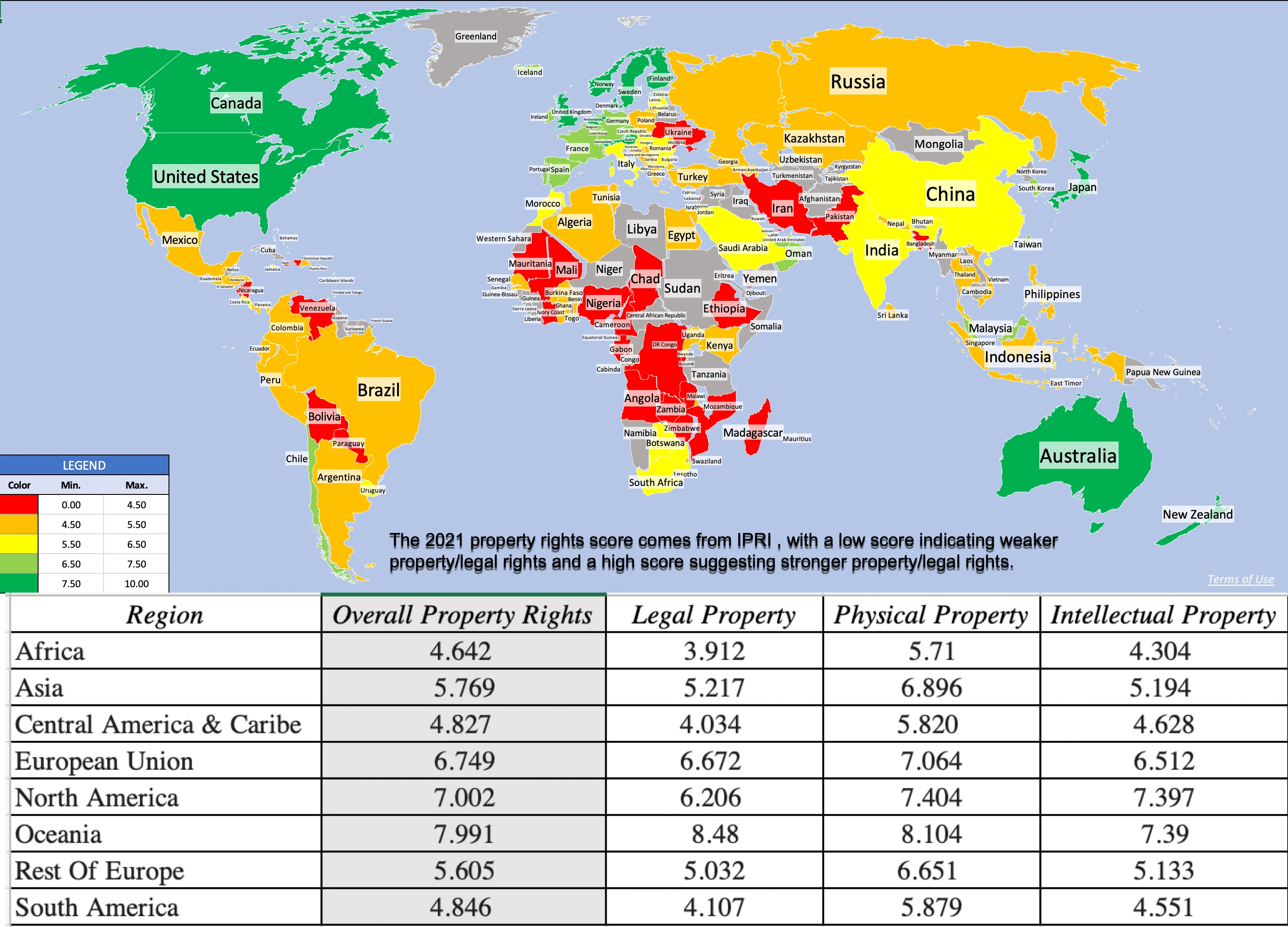

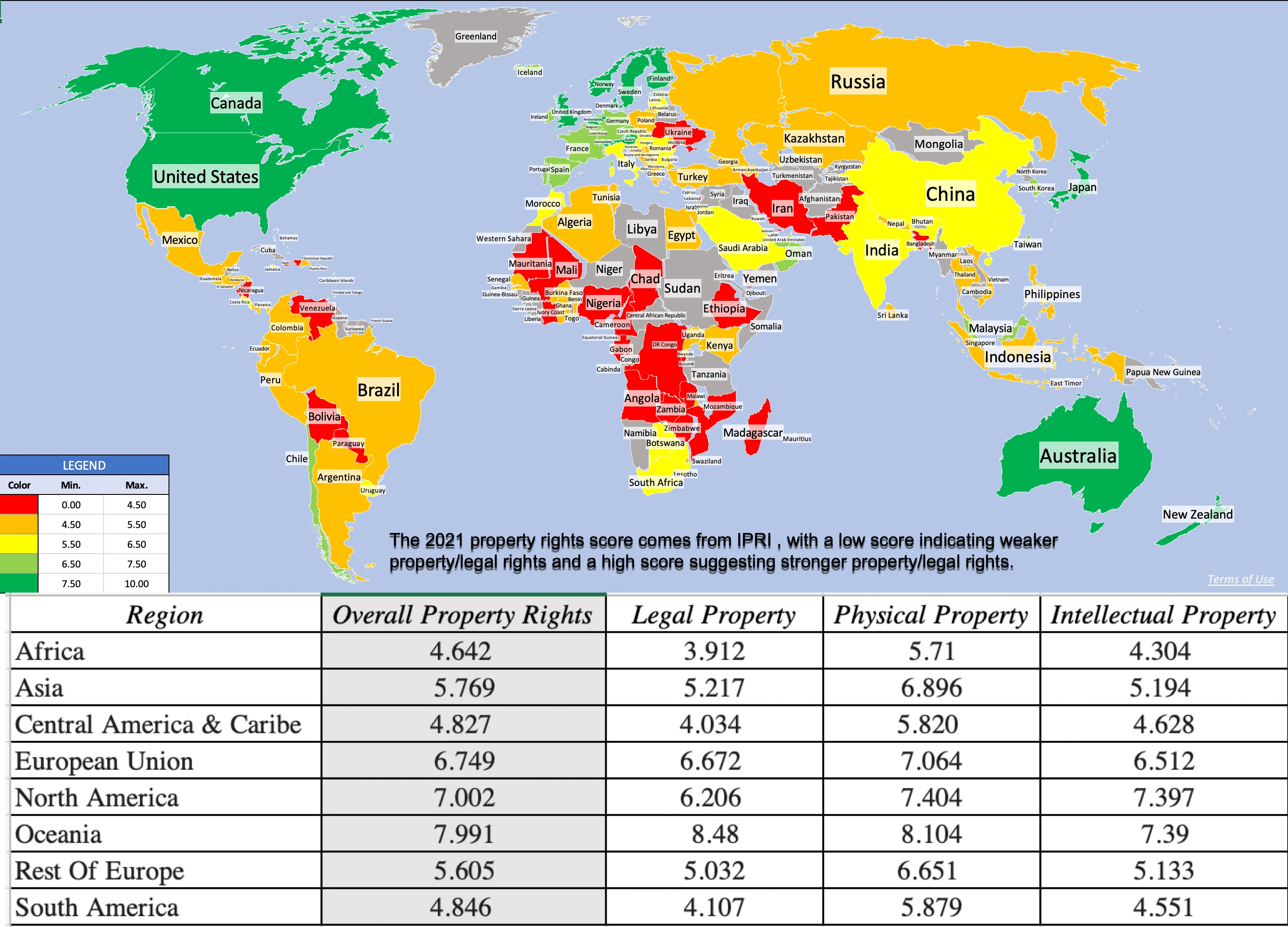

Finally, businesses are dependent on legal systems to enforce contracts and property rights, and legal protections vary widely across the world. I have mapped out an overall property rights score (based upon difference in physical, intellectual and legal property rights) below:

|

| Source: International Property Rights |

Legal protections for businesses are strongest in Australia and North America and weakest in Africa and Latin America.

While country risk has so many dimensions to it, there is correlation

across the many dimensions, with corruption, poor legal protections,

violence and political instability often moving in tandem. There are

several services that attempt to estimate composite country risk scores,

incorporating the multiple factors. One of my long-standing favorites

is Political Risk Services, which measures a country risk score on a

scale from 0 to 100, with lower scores indicating more risk and higher

scores associated with safety:

Source: The PRS Group

Based

on the PRS composite risk measures, Africa remains the most risky

region of the world for businesses to operate in, whereas Northern

Europe, North America and Australia offer the most safety.

Country Risk: Default Risk and Ratings

For investors, the most direct measures of country risk come from

measures of their capacity to default on their borrowings. At the start

of 2022, for instance, there were several countries that were in

technical default, on at least portions of their debt, and the Russian

invasion of Ukraine has exacerbated sovereign default concerns around

the world:

Source: Bank of England

To

measure sovereign default risk, ratings agencies (S&P, Moody’s,

Fitch) estimate sovereign ratings for countries, designed to capture

risk exposure in both local and foreign currency borrowing. The picture

below reports on Moody’s ratings, as of June 30, 2022:

Source: Moody's

Note that this picture has been updated to incorporate Russia’s rating reassessment (downgraded to Ca in

early April, before the rating was entirely withdrawn). I know that

there are some of you, who distrust ratings agencies, arguing that they

have regional and other biases and/or that they do not adjust ratings in

a timely fashion. If you are in that group, the sovereign CDS market

offers market-based and real-time measures of sovereign default risk,

although for only 80 countries, and the map below reports the sovereign

CDS spreads, as of June 30, 2022:

Source: Bloomberg

Comparing

the sovereign CDS spread picture to the sovereign ratings picture, you

can see the overlaps, with the ratings agencies and CDS market mostly in

agreement.

Country Risk: Equity Risk

For

equity investors, the price of risk is captured by the equity risk

premium, and equity risk premiums will vary across countries. I use a

template that starts with the implied equity risk premium that I compute

for the S&P 500 and then adds on a country risk premium that is

computed based upon the sovereign default spread (either from the CDS

market or based upon a sovereign rating), to get equity risk premiums

for countries:

The

equity risk premiums that result from this assessment are shown in the

picture below, with a very rough attempt to break down countries

geographically. (Please do not attach any political significance to my

country groupings, or take them personally. I mean no disrespect to any

country, and if you feel your country has been mis-grouped, I

apologize.):

Source: Spreadsheet with country risk premium data (Damodaran Online)

If

you compare the numbers in this picture to the equivalent one that I

reported at the start of the year, you can see the surge in risk

premiums across the board, starting with a higher base premium (6.01%,

up from 4.24%) for the US and higher spreads for country risk. Looking

at individual countries, the graph below summarizes the countries that

saw the biggest increases in equity risk premiums (on a percentage

basis) over the six months (from Jan 1, 2022 - June 30, 2022):

Not

surprisingly, Russia and Ukraine make the list, with Russia's equity

risk premium almost tripling and Ukraine's doubling over the period, but

you can see the spillover effects into Belarus and Kyrgyzstan. There

are three African countries that make the list (Namibia, Mali and

Ghana), largely because of ratings downgrades, Sri Lanka's downgrade

reflects the implosion of its political system and El Salvador's

experiments with Bitcoin are not going well.

Country Risk: Currency and Cost of Capital

As

a final part to this post, to see the shifts in country risk that we

have seen in 2022, let’s start with an assessment of risk free rates. In

my last post, I noted that concerns about inflation have played a big

role in pushing up the US ten-year treasury bond rate from 1.51% on Jan

1, 2022, to 3.02% on June 30, 2022. That increase in interest rates is

not restricted to the US dollar, as local currency government bond rates

have risen around the world. In the graph below, I use these government

bond rates as a starting point to estimate riskfree rates in multiple

currencies, with adjustments for default risk in governments, using the

sovereign default spreads from the last section:

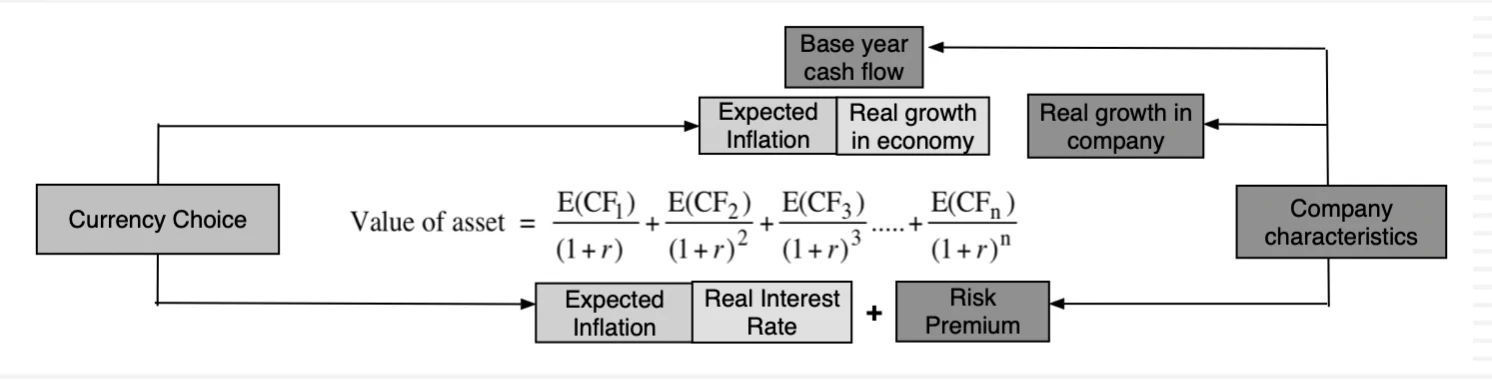

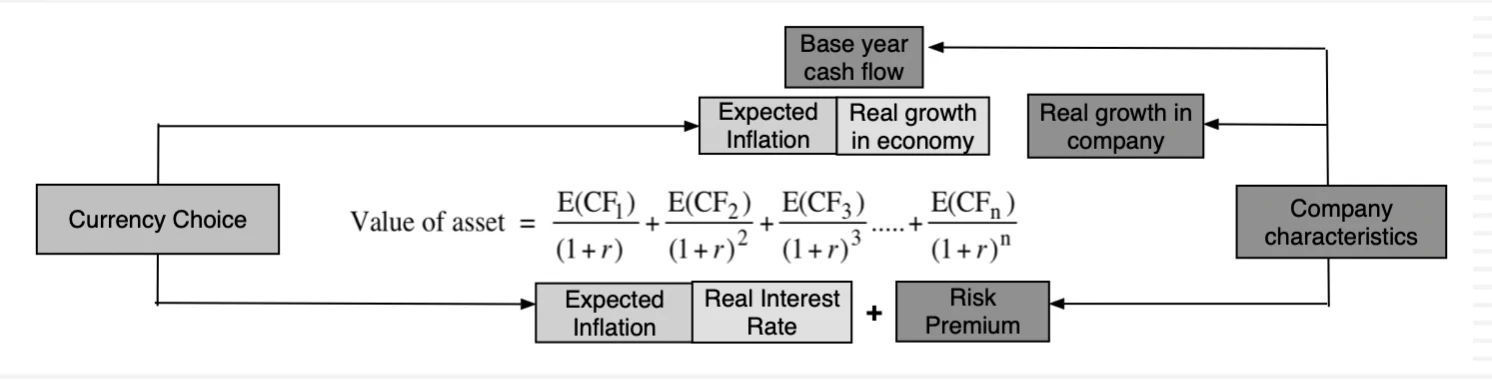

The

biggest reason for differences in risk free rates across currencies is

differences in expected inflation, with higher inflation currencies

exhibiting higher riskfree rates. That said, the key to dealing with

currency appropriately in valuation is to stay consistent, with cash

flows and the discount rates incorporating the same expectations of

inflation:

In

short, changing the currency that you use to value a company should not

fundamentally change your assessment of that company’s value, and the

reason that it often does in practice is because analysts are often

sloppy in their treatment of currency, mixing growth rates in one

currency with discount rates in another, and real with nominal numbers.

As a general principle, to prevent double or miscounting inflation

effects and risk, each input into discount rates carries a specific

component, with the riskfree rate being the conveyor of expected

inflation, the relative risk measure (beta for equity, bond rating for

debt) measuring the business and leverage risk of the company and the

equity risk premium/default spread reflecting the price of risk in

markets.

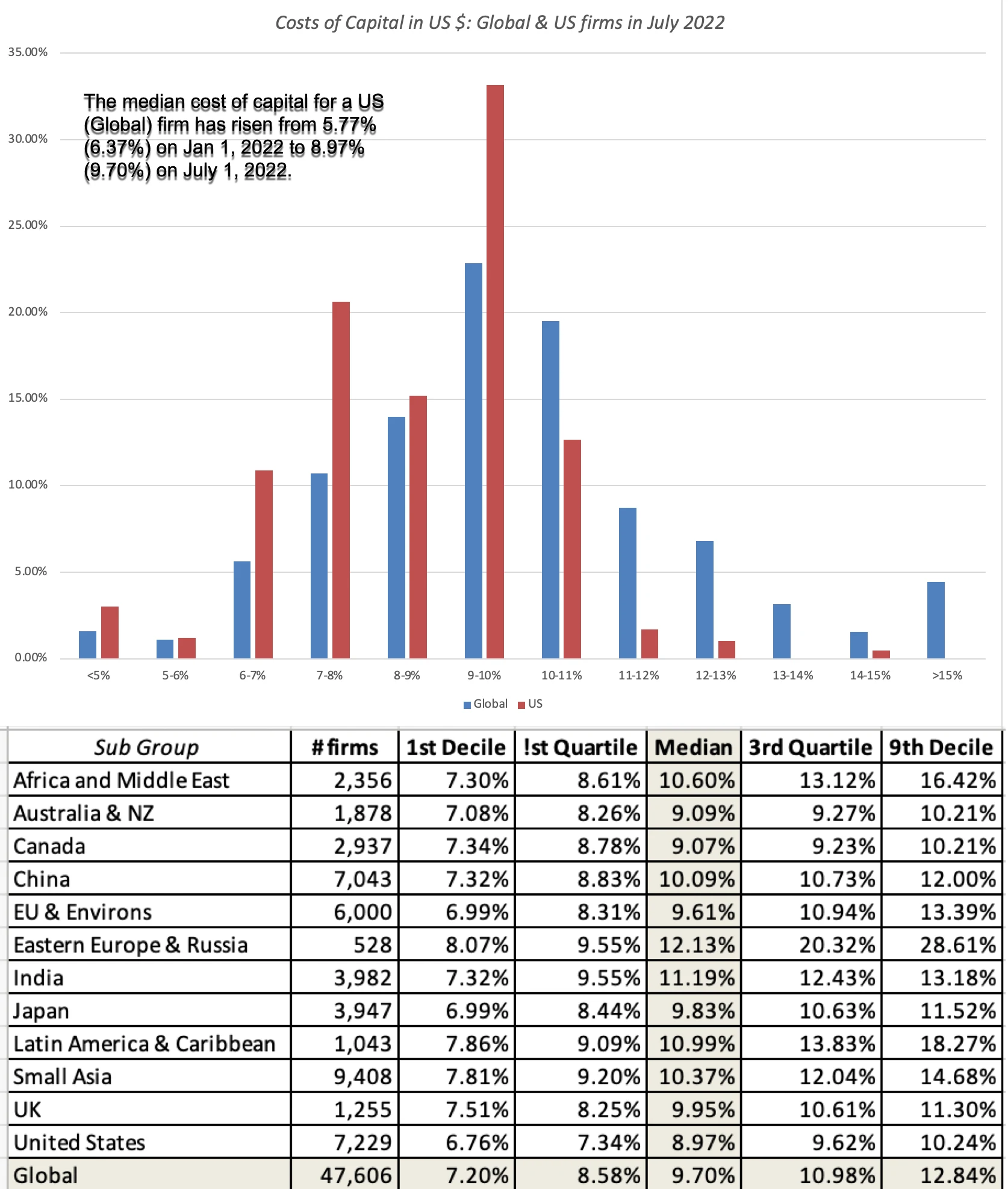

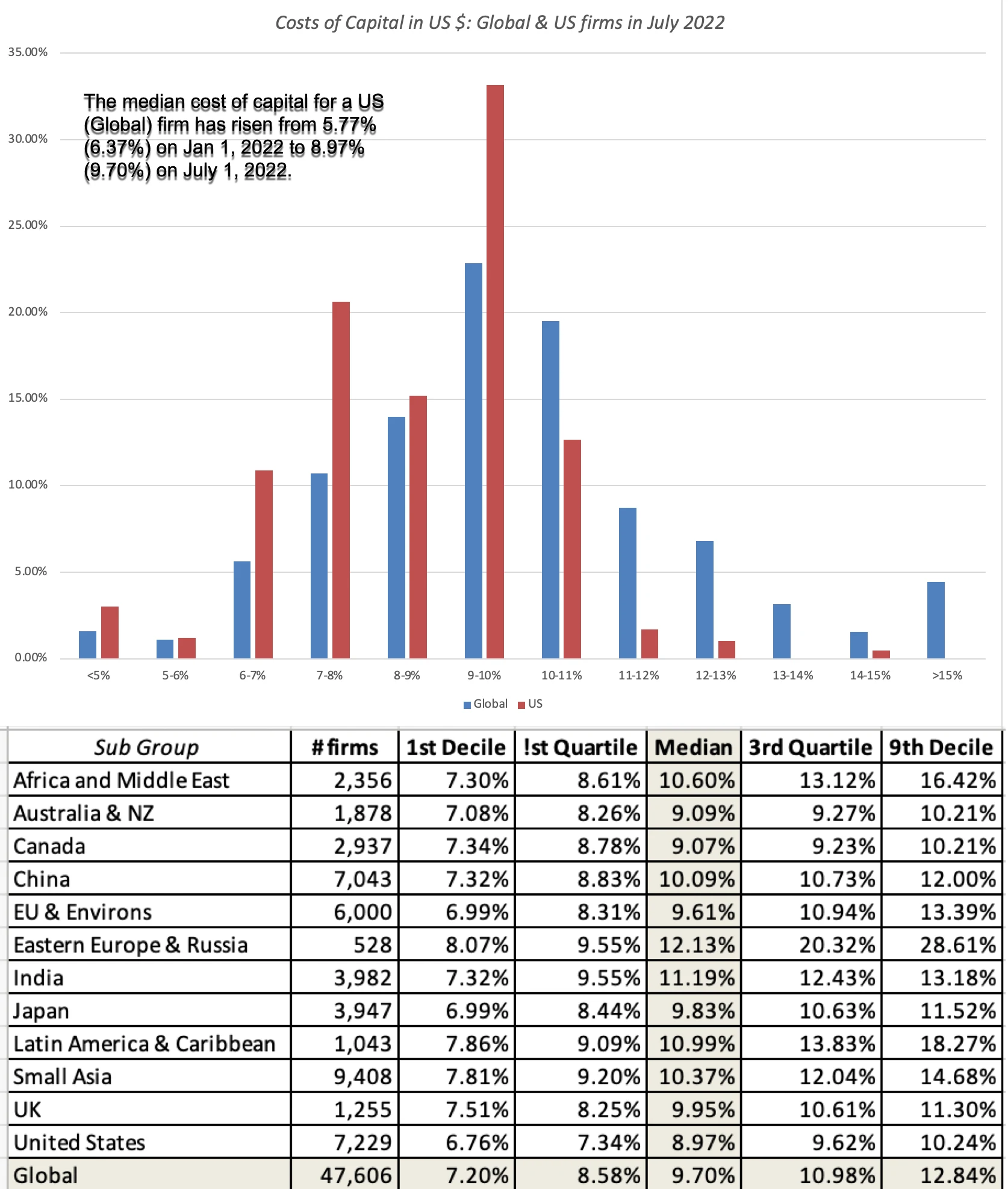

The

combination of rising risk free rates (not just in US dollars, but also

in other currencies) and surging risk premiums (default spreads and

equity risk premiums) is pushing up corporate costs of capital. In the

figure below, I graph the costs of capital for US and global firms, in

US$ terms, on July 1, 2022:

In

January 2022, I had posted a similar histogram of costs of capital for

global and US companies, reflecting risk free rates and risk premiums

then, and the change, over the six months, has been extraordinary, with

the median cost of capital for a US firm increasing from 5.77% to 8.97%,

and for a global firm, from 6.37% to 9.70%. As I look across the many

posts I have had this year on how inflation is changing market pricing

and psychology, I find myself drawing on one of my favorite Bob Dylan

lyrics, "the times, they are a'changin'". The biggest risk that we face,

as we navigate our way through uncharted territory, is inertia, where

we continue to do the things that have worked for the last decade, when

we need to adapt and change.

0 تعليقات